"I believe that the basic scenario is going to be one of a U-shaped economic recovery where growth is going to remain below trend ... especially for the advanced economies, for at least 2 or 3 years," he said at a news conference here.SOURCE: REUTERS

"Within that U scenario I also see a small probability, but a rising probability, that if we don't get the exit strategy right we could end up with a relapse in growth ... a double-dip recession," he added.

Roubini, a professor at New York University's Stern School of Business, said he was concerned economies which save a lot, such as China, Japan and Germany, might not boost consumption enough to compensate for any fall in demand from "overspenders" such as the United States and Britain.

"If U.S. consumers consume less, then for the global economy to grow at its potential rate, other countries that are saving too much will have to save less and consume more," he said.

Tuesday, September 8, 2009

Dr. Doom sounding less gloomy

201 Folsom on hold for up to 3 years

Via Socketsite comes news about 201 Folsom, Tishman Speyer's project across from the Infinity:

Tishman Speyer has been granted a 3 year extension to start construction on two approved residential towers of “350 and 400 feet above an 80-foot podium, with up to 725 dwelling units, 750 off-street parking spaces, 38,000 square feet of commercial space, and 272 replacement off-street parking spaces for the adjacent USPS facility” at 201 Folsom.SOURCE: SOCKETSITE

Labels:

new developments,

real estate,

san francisco,

soma,

tishman speyer,

transbay

Friday, September 4, 2009

Mortgage rates dip this week

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.08 percent with an average 0.7 point for the week ending September 3, 2009, down from last week when it averaged 5.14 percent. Last year at this time, the 30-year FRM averaged 6.35 percent.SOURC: FREDDIE MAC

The 15-year FRM this week averaged 4.54 percent with an average 0.6 point, down from last week when it averaged 4.58 percent. A year ago at this time, the 15-year FRM averaged 5.90 percent.

“Bond yields pushed mortgage rates slightly lower this week,” said Frank Nothaft, Freddie Mac vice president and chief economist. “Low mortgage rates are helping to keep housing very affordable. Seven of the top eight most affordable months occurred during this year, according to the National Association of Realtors’® (NAR) Housing Affordability Index, which dates back to 1971. As a result, pending sales of existing homes rose for the sixth straight month in July, a trend not seen since the NAR began reporting data in 2001. Moreover, July’s sales were the strongest since June 2007.

“Overall, inflation remains in check while certain sectors of the economy are experiencing some improvement. The core price index on consumer expenditures, a key indicator tracked by the Federal Reserve, rose 1.4 percent in July from the same time a year earlier and represented the smallest 12-month increase since October 2003. Meanwhile, the manufacturing industry expanded for the first time in 19 months, according to the Institute of Supply Management.”

Thursday, September 3, 2009

MBA proposes new secondary market framework

The Mortgage Bankers Association (MBA) today released a new paper outlining a proposed framework for a refined government role in the secondary mortgage market designed to ensure liquidity for mortgages without presenting unnecessary risks for the taxpayer. The paper, Recommendations for the Future Government Role in the Core Secondary Mortgage Market, is the result of work by MBA's Council on Ensuring Mortgage Liquidity, a 23-member task force representing MBA's diverse membership base.SOURCE: REAL ESTATE CHANNEL

"It's now been more than two years since the secondary mortgage market collapsed," said Michael D. Berman, MBA's Vice Chairman and Chair of the Council on Ensuring Mortgage Liquidity. "Rebuilding the secondary market is critical to restoring liquidity and confidence. The government has an important, limited role to play to ensure a stable flow of funds for mortgages."

The centerpiece of MBA's recommendation is the creation of a new line of mortgage-backed securities (MBS). Each security would have two components - a loan level guarantee provided by a privately-owned, government-chartered and regulated mortgage credit-guarantor entity (MCGE) and a security-level, federal government-guaranteed wrap.

The wrap would be an explicit government guarantee focused on the credit risk of these mortgage securities, similar to that on a Ginnie Mae security. Fannie Mae and Freddie Mac's infrastructure, including their technology, human capital, standard documents and relationships, could be used as the foundation for one or more MCGEs.

Labels:

mortgage-backed securities,

real estate

Economy to grow 3.3% in Q3

For the third quarter, economists at Goldman Sachs & Co. predict the U.S. economy will grow by 3.3%. "Without that extra stimulus, we would be somewhere around zero," said Jan Hatzius, chief U.S. economist for Goldman.Time to start building again, guys...

SOURCE: WSJ

Fed: recession ended in August

With the economy on the mend, Federal Reserve policymakers last month felt comfortable slowing the pace of one of its economic revival programs and not changing any others, according to documents released Wednesday.Have we reached the "bottom" of our real estate market? It's starting to look more and more like the answer is yes. Loyal followers know we've been critical of economic conditions for the past 6 months (which is why most of our postings have been about economic news) but the stabilization of the economy and the local market seems to be real and sustained, at this point. Of course conditions can change (if interest rates jump up; if unemployment takes it's toll on the technology industry; if foreclosures continue to rise without loan modification workouts), but we should be fine in San Francisco for the time being.

Minutes of the central bank's closed door deliberations, held Aug. 11-12, also showed Fed Chairman Ben Bernanke and his colleagues striking a much more hopeful note about the economy's prospects compared with an assessment made in late June. Many Fed officials saw "smaller downside risks," the documents stated.

Fed officials expected the pace of the recovery to "pick up" in 2010, but there was a range of views — and considerable uncertainty — about the likely strength of the upturn because of concerns about how consumers will behave.

After being pounded by the recession, consumer spending finally appeared to be leveling out, the housing market was firming and manufacturing was stabilizing, the Fed said. Plus, the outlook for other countries' economies improved, auguring well for the sale of U.S. exports.

As such, we're now comfortable getting back to providing information about specific properties and buildings. So if you're interested in new San Francisco developments, like Blu, Soma Grand, the Infinity, One Rincon Hill, Millennium Tower, or the Arterra, or a classic San Francisco home in another neighborhood, our agents are here to help. Feel free to email us at highrisesf@gmail.com.

SOURCE: AP

Wednesday, September 2, 2009

Q2 home prices rise 1.7% nationwide

The average price of homes bought with mortgages funded by Freddie Mac rose 1.7 percent during the second quarter and for the first time in two years there were gains in every part of the U.S.SOURCE: BLOOMBERG

The quarterly increase followed a 1.5 percent drop during the first quarter, according to a report today from the McLean, Virginia-based mortgage buyer. Measured from a year earlier, home prices fell 6.7 percent, slower than the first quarter’s 8.5 percent annual decline.

Demand is returning to the U.S. housing market after a three-year slump cut values nationwide and led to record foreclosures. The number of contracts to buy previously owned homes rose more than forecast in July and increased for a record sixth consecutive month, reinforcing signs that the housing market is steadying.

“The pickup in home price growth rates is consistent with other housing market indicators that show home sales and single- family construction up in the second quarter,” said Frank Nothaft, Freddie Mac vice president and chief economist, in a statement.

Mortgage applications drop week-to-week

Mortgage applications filed last week decreased a seasonally adjusted 2.2% compared with the week before, even though mortgage rates improved somewhat, the Mortgage Bankers Association reported on Wednesday.Good stats here: refis dropped (in spite of dipping rates); ARMs only make up 5.6% of applications (showing future stability in lending). Will next week or two weeks from now show an increase in applications (as we enter the typically strong post-Labor Day period? We'll see soon. And that will give us a good indication of what the market will do for the rest of the year.

Applications for the week ended Aug. 28 were up an unadjusted 22.7% from the same week in 2008, the MBA said. The Washington-based MBA's survey covers about half of all U.S. retail residential mortgage applications.

The week-to-week drop marked a downturn from the comparable 7.5% increase in filings for the week ended Aug. 21.

Mortgage applications to purchase home for the latest week were down a seasonally adjusted 1.0%, compared with the week before. Included within those purchase applications, government-insured mortgages, such as those through the Federal Housing Administration, were up a seasonally adjusted 0.5% from the prior week, according to the MBA's survey.

The government-insured share of mortgage purchase applications for August stood at 40.4%, up from 38.3% in July. The increase put government-insured mortgages at the highest proportion seen since February 1991, the MBA said.

Meanwhile, applications to refinance existing home loans were down 3.1% on a week-to-week basis.

Refinancings accounted for 56.5% of all filings last week, unchanged from the prior week. Adjustable-rate mortgages made up 5.6% of all mortgages, down from 6.5%.

SOURCE: MARKET WATCH

Tuesday, September 1, 2009

WWJD: What Whould Jim (Cramer) Do

Housing Is Back, Despite Media's WorriesSOURCE: FORECLOSURES.COM

By Jim Cramer

RealMoney Columnist

8/27/2009 6:03 PM EDT

Sometimes the misdirection in the media's interpretation of the mortgage/foreclosure market simply drives me up a wall. Take this morning's fret story, "Loans That Looked Easy Pose Threats to Recovery," in The New York Times. This one is played big online, much bigger than another story, "Signs of Life as Sales of New Homes Improve." The gist of the big story? Option rate ARMs are going to crimp anything good that could happen from the housing recovery.

But you know what? The amazing thing here is the number of option ARMs that they say we are in trouble on: 500,000 homes. Sorry, I know that number is meant to scare people, but it is truly small, especially when you consider that 17 million homes traded during the period from 2005 to the first quarter of 2007, when the reckless lending set in. Given the charges we have taken in the banking system, the reserves we have, the bottom in housing and the robust market we have -- and it isn't just for first-time homebuyers, and it isn't just for low-dollar homes, despite the impressions made by the media -- you have to take this worry and throw it out.

It's like the foreclosure worry. Somehow we keep hearing that the foreclosures are overwhelming the markets. If that's the case, how can new-home sales soared 9.6%? How can home inventories be down 37% year over year and the foreclosure market be ballooning inventory at the same time? Of course the trick here is twofold: very few new homes being built - one-quarter of the peak -- and household formation -- almost a million new homebuyers every year.

We then hear that the buying is all $8,000 tax credit related. To which I say, you have to be kidding me. The demand for homes is real because they are affordable, a combination of price declines and mortgage rates.

Plus, and this is an important plus, we continually hear that the banks are holding back foreclosed homes. First it was because of moratoriums. Now it is because banks don't want to take the losses. Oh come on, they are selling what they have to sell, and they are watching house prices appreciate. We can keep endlessly coming up with reasons why the bottom isn't real. But let's be very clear, this option ARMs problem is not that big, not that big at all.

As a housing bull, I found the piece gratifying.

Pending home sales continue to rise; up 3.2% from June to July

Contract activity for pending home sales has risen for six straight months, a pattern not seen in the history of the index since it began in 2001, according to the National Association of Realtors®.SOURCE: NAR

The Pending Home Sales Index,1 a forward-looking indicator based on contracts signed in July, increased 3.2 percent to 97.6 from a reading of 94.6 in June, and is 12.0 percent higher than July 2008 when it was 87.1. The index is at the highest level since June 2007 when it was 100.7.

Lawrence Yun, NAR chief economist, said the housing market momentum has clearly turned for the better. “The recovery is broad-based across many parts of the country. Housing affordability has been at record highs this year with the added stimulus of a first-time buyer tax credit,” he said.

Friday, August 28, 2009

First-time buyer credit may be extended, increased

Bills to extend the maximum $8,000 tax credit for first-time home buyers, which expires Nov. 30, are pending in both the U.S. House and the Senate.SOURCE: REALTOR MAGAZINE

Sen. Christopher J. Dodd, a Connecticut Democrat and chairman of the Senate Banking, Housing, and Urban Affairs Committee, is co-sponsor of a bill with Georgia Republican Sen. Johnny Isakson that would raise the credit amount to a maximum of $15,000.

Senate Majority Leader Harry M. Reid of Nevada favors an extension of the current credit. He was quoted by the Las Vegas Sun saying, "It's something we can get done."

Odds are that the credit will be extended and broadened to cover all buyers next year, but the chances of the amount increasing aren’t as good, observers say.

Low mortgage rates fueling increase in sales

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey (PMMS) in which the 30-year fixed-rate mortgage (FRM) averaged 5.14 percent with an average 0.7 point for the week ending August 27, 2009, up from last week when it averaged 5.12 percent. Last year at this time, the 30-year FRM averaged 6.40 percent.SOURCE: REAL ESTATE CHANNEL

The 15-year FRM this week averaged 4.58 percent with an average 0.7 point, up from last week when it averaged 4.56 percent. A year ago at this time, the 15-year FRM averaged 5.93 percent.

"Long-term mortgage rates were barely changed this week, remaining historically low, which is helping to sustain a high level of affordability in the home-purchase market," said Frank Nothaft, Freddie Mac vice president and chief economist." Low rates contributed to existing home sales rising for the fourth consecutive month to an annual pace of 5.24 million in July, the most since August 2007, according to the National Association of Realtors®.

"Similarly, new home sales rose for the fourth month in a row to 0.4 million, the strongest pace since September 2008, the Commerce Department reported. The sales gain helped to reduce the number of new unsold houses on the market to the lowest amount since March 1993. In addition, house prices in June rose nationally for the second consecutive month, according to the Federal Housing Finance Agency's purchase-only house price index."

Thursday, August 27, 2009

Mortgage applications jump 7.5%

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending August 21, 2009. The Market Composite Index, a measure of mortgage loan application volume, increased 7.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 6.3 percent compared with the previous week and 34.1 percent compared with the same week one year earlier.SOURCE: REAL ESTATE CHANNEL

The Refinance Index increased 12.7 percent from the previous week, the third increase in the last four weeks. The seasonally adjusted Purchase Index increased 1.0 percent from one week earlier, solely boosted by increased demand for government loans. This marks the fourth consecutive weekly gain - the first time this has happened since March, when fixed mortgage rates first dropped and stayed below 5 percent.

The four week moving average for the seasonally adjusted Market Index is up 3.5 percent. The four week moving average is up 1.7 percent for the seasonally adjusted Purchase Index, while this average is up 4.8 percent for the Refinance Index.

Wednesday, August 26, 2009

New homes sales increase 9.6% in July

Purchases of new homes in the U.S. jumped more than forecast in July, adding to signs that the economy is rebounding from the worst recession since the 1930s.SOURCE: BLOOMBERG

Sales increased 9.6 percent, the most since February 2005, to a 433,000 annual pace, figures from the Commerce Department showed today in Washington. The number of houses on the market dropped to the lowest level in 16 years.

The gain in sales, together with rising purchases of existing homes and steadying prices, indicate the housing slump may be ending as Federal Reserve efforts to thaw credit and the Obama administration’s first-time homebuyer incentives lift demand. Job losses and mounting foreclosures mean any rebound in construction may be limited.

Mission Bay ready for its close up

It's taken four mayors and three planning directors to create what is now the last swath of San Francisco land where planners can create a neighborhood from scratch. So far, 3,000 people have moved into the 300-acre rail yard south of the Giants baseball park. The neighborhood is 35 percent built, and 15 years from now, it's expected to have 11,000 residents.All in all, it's starting to feel like a neighborhood. Hopefully SWL 337 won't take as long to complete.

Mission Bay feels as if it escaped the economic downturn - stores are opening, buildings are going up, and young professionals are zipping out of $700,000 condos to get to work. Most live in a six-block area north of Mission Bay Creek. These pioneers say it's now starting to feel like a place worth staying in on the weekends.

"It's changed a lot. It's way more crowded now," said Claudia Arrenberg, 27, who shopped for pasta and fruit with her 2-year-old daughter at the new Mission Bay Farmers' Market.

SOURCE: SFGATE

Labels:

mission bay,

new developments,

real estate,

san francisco

Consumer confidence up

The Conference Board, a New York-based business research group, said Tuesday that its Consumer Confidence Index rose to 54.1 in August from an upwardly-revised 47.4 in July.SOURCE: CNN MONEY

Economists were expecting the index to increase to 48, according to a Briefing.com consensus survey. The measure is closely watched because consumer spending makes up two-thirds of the nation's economic activity.

Labels:

consumer confidence,

economic news

Tuesday, August 25, 2009

More appraisal woes - Part 2

I have a deal in contract now going through this very problem. Inexperienced, inadequate appraisers hold the power to disrupt and scuttle deals (my appraiser clearly didn't have a basic understanding of how to equalize comps to the subject property, something even I learned before obtaining my broker's license).

SOURCE: NY TIMES

Since national lenders cannot maintain lists of appraisers in every community, they long ago began outsourcing the process to the management companies, who had claimed about 30 percent of the market before the code took effect. Now that the lenders are the ones ordering all the appraisals, the management companies are expanding their share.This has to change. There has to be an appeals process to keep inexperienced appraisers from ruining deals, and the market by extension.

Real estate groups say the management companies, with the competition from brokers and agents eliminated, are now trying to fatten their profit margins by hiring appraisers as cheaply as possible.

These inexperienced appraisers, often traveling many miles to a market they do not know well, are scuttling legitimate deals, the agents claim.

SOURCE: NY TIMES

The Price is Right (in Miami)

Are you listening, San Francisco developers? Want more sales? It's all about pricing. Get in front of the market again and you'll make sales.

Are the good 'old days of real estate back? It appears so in Downtown Miami.SOURCE: CBS 4

In recent weeks developers have sold hundreds of condos, in a flurry of activity they haven't seen since the peak of the housing market. Some builders are actually running out of inventory. The first building to sell out, Brickell on the River, happened quietly and quickly selling 120 units in just six weeks time.

"It's pretty impressive when you walk into a sales office and you have 20-30 people waiting to see units. Sounds crazy but it's actually happening now," Andres Asion, with Miami Real Estate Group, told CBS4's David Sutta.

Before Asion could deposit the checks, he had sold out the entire building out; something developers in this area have not been able to do for the past three years.

So how did Asion do it?

Price. They dropped it roughly a $100 thousand under their closest competition. The final prices were half of what units sold for at the peak of the market.

"You could see it in the pricing. When you could buy a two bedroom condo for $220,000 in which before it was $450,000 people are really pulling the trigger," Asion said.

Labels:

new home sales,

real estate,

san francisco

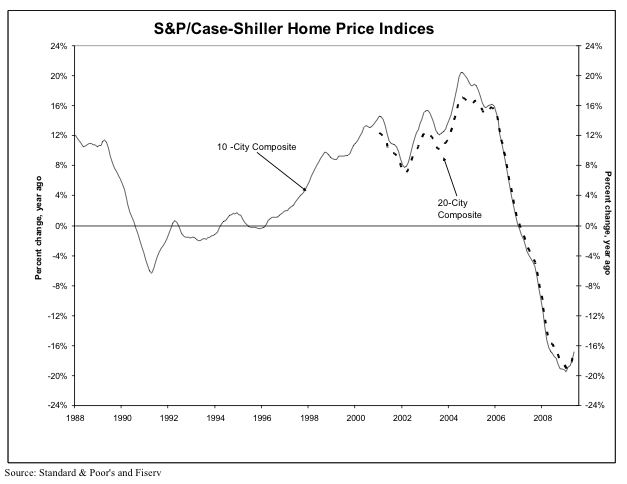

June Case-Shiller Index up 3.8% MOM

June's Case-Shiller Index rose 3.8% from May to June in the San Francisco MSA.

After three years of declines, home prices increased 2.9% in the three months ended June 30, according to the latest S&P/Case-Shiller report. That is the first quarter-over-quarter improvement in three years.SOURCES: S&P and CNN MONEY

Prices in the national index are down 14.9% compared with the second quarter of 2008, the report said. But that is better than the record 19.1% decline that was set in the first three months of 2009.

"We're seeing some positive signs," says David M. Blitzer, Chairman of the Index Committee at Standard & Poor's.

Among cities, Cleveland reported the biggest rebound during the three months; prices improved by 4.2%. San Francisco prices rose 3.8% and Minneapolis 3.1%. Prices declined in only two of the 20 cities, Las Vegas, down 2%, and Detroit, down 0.8%.

Despite the upbeat report, Robert Shiller, one of the principle authors of the Case-Shiller index, expressed caution, pointing out that last year's turnaround quickly fizzled out.

In early 2008, prices were falling 3% a month. That improved to -0.5% a month in the spring, giving the impression that the market would turn around. But prices quickly started falling more steeply again. The same thing could happen again, especially with the economy still in a downspin.

"The really important things [affecting home prices] are unemployment and momentum," said Shiller, who is a Yale economist. "We have momentum, which is very important, but we also have high unemployment."

And, he added, "the government has not yet handled the foreclosure problem."

Shiller, too, is relatively optimistic despite being cautious. "I have found that momentum matters," he said, "and this is a sudden break in [downward] momentum. The [market] psychology seems to be changing."

Monday, August 24, 2009

Roubini: risk of double-dip recession

Nouriel Roubini, one of the few economists who accurately predicted the magnitude of the world's recent financial troubles, sees a "big risk" of a double-dip recession, according to an opinion piece posted on the Financial Times' Web site on Sunday.SOURCE: CNBC

Roubini, a professor at New York University's Stern School of Business, said it appears the global economy will bottom out in the second half of this year, and that U.S. and western

European economies will likely experience "anemic" and "below trend" growth for at least a couple of years.

Yet he warned that policymakers face a "damned if they do and damned if they don't" conundrum in trying to unwind their massive fiscal and monetary stimuli to keep the global economy from toppling into a depression.

Resales jump 7.2% in July - largest increase in 2 years

Sales of previously owned U.S. homes jumped 7.2 percent in July to mark the fastest sales pace in nearly two years, an industry survey showed Friday, in a strong sign that housing is pulling out of a three-year slump.SOURCE: CNBC

Sales in July rose for the fourth straight month to hit an annual rate of 5.24 million units, the highest rate since August 2007, the National Association of Realtors said, beating market expectations for a 5 million unit pace. Sales in June had been at a 4.89 million pace.

July's increase was the largest monthly gain since the series started in 1999. The last time sales rose for four consecutive months was in June 2004, the NAR said.

Thursday, August 20, 2009

Commercial real estate down from Q1 to Q2

U.S. commercial real estate activity in the second quarter slowed to its lowest level in 15 years as demand for office and retail space collapsed amid the severe recession, a real estate trade group said on Wednesday.SOURCE: REUTERS

The National Association of Realtors (NAR) said its Commercial Leading Indicator for brokerage activity index fell 1.3 percent to 101.5 in the second quarter, the lowest reading since the first three months of 1994.

"The reduction in commercial real estate activity is expected to last at least through the first quarter of 2010. Any meaningful recovery is not likely to occur before the second half of next year," said NAR chief economist Lawrence Yun.

Chinese investors buying mortgage-back securities

Not so "toxic" to the Chinese, so it seems.

China's $200 billion sovereign wealth fund, which suffered big paper losses on stakes in Morgan Stanley (MS, Fortune 500) and Blackstone (BX), is set to invest up to $2 billion in U.S. mortgages as it eyes a property market recovery, two people with direct knowledge of the matter said Monday.SOURCE: CNN

China Investment Corp. (CIC) plans to invest soon in U.S. taxpayer subsidized investment funds of toxic mortgage-backed securities, which it sees as a safer bet than buying into the Federal Reserve's Term Asset-Backed Securities Loan Facility (TALF).

Under the Public-Private Investment Plan (PPIP) launched earlier this year, the U.S. government plans to seed a number of public-private investment funds that would combine taxpayer money with private capital to buy as much as $40 billion in toxic securities from banks.

Compared with TALF, the new and smaller PPIP program focuses on safer toxic securities, which must have triple-A ratings from at least two agencies, and are debts guaranteed by the Federal Deposit Insurance Corporation (FDIC), sources explained.

"In this case, CIC feels safer to invest and the safer it feels, the more confident it will naturally feel about its investments, as well as in the prospects for the U.S. economy," said one of the sources.

Labels:

mortgage-backed securities,

real estate

Tuesday, August 18, 2009

Single family starts and permits up in July

Production and permitting of new single-family homes continued on an upward trajectory in July, according to newly reported numbers from the U.S. Commerce Department today. Meanwhile, substantial declines on the multifamily side dragged down the overall numbers, with combined single- and multifamily starts down 1 percent to a seasonally adjusted annual rate of 581,000 units and combined single- and multifamily permits down 1.8 percent to a 560,000-unit rate.The good news is tempered by the potential expiration of the first-time buyer credit, due to expire in November:

“The latest report marks a fifth consecutive month of improvement in single-family housing starts and a fourth consecutive month of improvement in single-family permits,” noted NAHB Chief Economist David Crowe. “This is exactly in keeping with our latest member surveys, which indicate that builders are cautiously optimistic about single-family sales conditions over the next several months. That said, the significant drop-off in multifamily construction and permitting shown in recent months’ reports may be a harbinger of the financing challenges facing all home builders going forward. A severe lack of credit for acquisition, development and construction financing, along with other issues tied to low appraisals and the upcoming expiration of the first-time buyer tax credit, could derail the progress made so far. Government action is required to ensure that housing can help generate jobs and economic growth in the days ahead.”

“With the impending expiration of the first-time home buyer tax credit at the end of November, July was probably the last month in which to get homes permitted and started in time for customers to take advantage of that valuable incentive,” noted Joe Robson, chairman of the National Association of Home Builders (NAHB) and a home builder from Tulsa, Okla. “Builders were responding to improved demand related to that upcoming deadline and also to the first signs of an economic recovery.SOURCE: NAHB

However, it remains to be seen what happens after the tax credit expires, and the severe credit crunch that has curtailed many multifamily projects is looming over single-family builders as well. Congress and the Administration need to take action now in order to maintain the momentum toward a housing and economic recovery.”

Labels:

housing starts,

new construction,

real estate

Monday, August 17, 2009

New home industry expectations up

The NAHB and Wells Fargo index improved month-to-month, along with new sales expectations:

More signs the U.S. economy was exiting its worst recession in 70 years emerged on Monday with reports showing confidence rising among homebuilders, factory activity perking up in New York state and credit card defaults slowing.SOURCE: REUTERS

The National Association of Home Builders and Wells Fargo said their Housing Market Index edged up one point to 18 in August -- the highest level since June 2008 and the second consecutive monthly gain.

The residential housing market's three-year slump shows signs of turning the corner. In the NAHB survey, the sales expectations measure for the next six months climbed four points in August to 30. The traffic of prospective buyers index rose three points to 16 in the same month.

Labels:

new developments,

new home sales,

real estate

Park Merced development latest victim of economic downturn

Via Socketsite comes news that SummerHill is backing out of their proposed development at Park Merced:

The owner of the Park Merced Shopping Center has decided to lease up the building after its to sale Peninsula residential builder SummerHill Homes fell through. SummerHill had planned to do a $47 million, 195-unit proposed mixed-use development across from Villas ParkMerced.SOURCE: SOCKETSITE

Labels:

new developments,

real estate,

san francisco,

summerhill

Thursday, August 13, 2009

2nd quarter existing home sales up 3.8% nationwide

"Just the facts please, ma'am":

SOURCE: NATIONAL ASSOCIATION OF REALTORS

Existing-home sales in the second quarter showed healthy gains from the first quarter in the vast majority of states, and price declines have increased affordability in most metro areas, according to the latest survey by the National Association of Realtors®.Good news for Q2, on top of the previously discussed good news on price, DOM, and inventory.

Total state existing-home sales, including single-family and condo, rose 3.8 percent to a seasonally adjusted annual rate1 of 4.76 million units in the second quarter from 4.58 million units in the first quarter, but remain 2.9 percent below the 4.90 million-unit pace in the second quarter of 2008.

Thirty-nine states experienced sales increases from the first quarter, and nine states were higher than a year ago; the District of Columbia showed both quarterly and annual rises.

Lawrence Yun, NAR chief economist, said the sales gain appears to be sustainable. “With low interest rates, lower home prices and a first-time buyer tax credit, we’ve been seeing healthy increases in home sales, which are a hopeful sign for the economy,” he said. “There have been sustained sales gains in Arizona, Nevada and Florida, as well as diverse areas such as Maryland, the District of Columbia and Nebraska. More recently, we’ve seen strong double-digit gains in Idaho, Utah, New Mexico, Washington, Hawaii, New York, New Jersey, Maine, Vermont, Wisconsin, Indiana, South Dakota and Montana.”

SOURCE: NATIONAL ASSOCIATION OF REALTORS

Labels:

economic news,

home sales,

real estate

Wednesday, August 12, 2009

Who's buying in this market?

While working in managment of new construction sales offices, my mantra for buying demographics was always "first-timers" and "empty-nesters". Well, buried in an article on shrinking house sizes (and the impending death of McMansions) was a quote from Toll Brothers:

SOURCE: CNN MONEY

It's also hard to know whether the trend is a the result of a change in attitudes or a change in buyers, according to Kira McCarron, the chief marketing officer for Toll Brothers, an upscale homebuilder...Which is part of the reason I left Toll Brothers in 2005, selling McMansions in San Ramon, to work for condo developers. I knew the coming economic downturn would be weathered better by young professionals who rent, and empty nesters who have 30 years worth of equity built up. They can more easily survive a 25% equity drop, selling their homes which in many cases are already paid off, and moving to urban centers. Looking at sales around the city, a majority of new home buyers are empty nesters and first timers. Add in move-up buyers leaving high-rises for single family homes, and we have a good mix of supply and demand in San Francisco. Our market should continue to be strong as long as this keeps up.

"The active adult product is taking a bigger share of the market right now," said McCarron, leading to more small homes and dragging the average new home-size data down.

SOURCE: CNN MONEY

Hump Day blues

In true "Hump Day" style, today we bring you news from Zillow's COO regarding the outlook for the coming year. The bottom line: foreclosures may still drag housing prices lower.

SOURCE: CNBC

Despite a new report from Zillow.com that the annual rate of home price declines improved for the first time in ten quarters, the company’s COO does not think prices are anywhere near out of the woods yet.The potential for new foreclosures, on top of the rumored "shadow inventory" on the banks balance sheets, could spell further price reductions. Will this impact us here in San Francisco? Possibly, and probably if foreclosures become a big issue here, but to what degree is anyone's guess. An additional 15-20% drop? Maybe not, if our job market continues to improve. Keep following to find out.

He thinks some of the real estate bulls are not factoring in foreclosures nearly enough.

“One in four Americans now who have a mortgage are underwater on their loan at least somewhat so a lot of Americans can't qualify for Making Home Affordable [govt. modification plan], can't qualify for a loan modification or are caught up in the paperwork and bureaucracy of what it takes to modify your loan,” says Zillow’s Spencer Rascoff.

“In the second half of 2009, home values are going to continue to decline. Foreclosures are going to keep making up a significant part of the sales, probably about a quarter of all sales in the back half of 2009 nationwide will be foreclosures,” says Rascoff, adding, “I think you'll have those homes clear off the market but new foreclosures come on the market right behind them.”

Rascoff believes we are a full year away from a true national bottom in housing, but even then, he says, don’t expect to make money fast. “You're not going to see a return to rapid appreciation from a couple of years ago," he opines. "This is probably going to be an L-shaped recovery where home values stay relatively constant once they hit the bottom."

SOURCE: CNBC

Labels:

economic news,

foreclosures,

home sales,

real estate

Monday, August 10, 2009

Commercial real estate troubles keeping interest rates low

The collapse in commercial real estate is preventing Federal Reserve Chairman Ben S. Bernanke from declaring the economy and financial markets are healed.SOURCE: BLOOMBERG

Property values have fallen 35 percent since October 2007, according to Moody’s Investors Service. That’s making it tough for owners to refinance almost $165 billion of mortgages for skyscrapers, shopping malls and hotels this year, pressuring companies such as Maguire Properties Inc., the largest office landlord in downtown Los Angeles, to put buildings up for sale...

If nonresidential real estate remains in the doldrums, the Fed may be forced to leave emergency-lending programs in place and keep its benchmark interest rate close to zero for longer than some investors expect, given positive signs elsewhere in the economy.

Commercial property is “certainly going to be a significant drag” on growth, said Dean Maki, a former Fed researcher who is now chief U.S. economist in New York at Barclays Capital Inc., the investment-banking division of London-based Barclays Plc. “The bigger risk from it would be if it causes unexpected losses to financial firms that lead to another financial crisis.”

Labels:

commercial real estate,

economic news

Wednesday, August 5, 2009

Robert Shiller on Charlie Rose

Worth watching. Shiller touches on real estate, financial innovation, herd mentality, The Great Depression, and much more.

Labels:

charlie rose,

economic news,

real estate,

shiller

Tuesday, August 4, 2009

Q2 analysis

A quick breakdown of Q2 activity, nationwide. Visit the pdf via link below for raw numbers by MSA

Price Index:

$697,376 - April

$720,060 - May

$742,596 - June

3.1% - % change May to June

6.5% - 3 mo. % change

Listing Inventory:

10,283 - April

9,302 - May

9,014 - June

-3.1% - % change May to June

-12.3% - 3 mo. % change

Average Days on Market:

96 - April

96 - May

94 - June

-1.4% - % change May to June

-1.9% - 3 mo. % change

SOURCE: ALTOS RESEARCH

The Altos Research 10-City Composite Index was up by 1.3% in June and 3.9% during the most recent three-month period.For San Francisco real estate, specifically:

Prices increased in 22 of 26 markets with 21 markets currently showing three months of sequential price increases. Through the first half of 2009, listing prices for single family home rose materially in most of the country. There is some recent evidence, not yet reflected in the data in this report that the home price rebound peaked in early June, and prices may resume a decline for the near-term future.

The Altos 10-City Composite Index continues to highlight a shift in properties available on the market. The market has experienced some turnover at the low-end (two years after the first sub-prime collapse) while new properties on the market are shifting to the higher-end.

The California markets of Los Angeles and San Diego showed the largest monthly listing price increase with rises of 6.6% and 6.0% respectively. The largest monthly drop in asking prices occurred in Las Vegas with prices falling 2.1% but that was a markedly slower rate of decline than the 3.7% rate last month.

Listed property inventory increased in 16 of 26 markets and was down in 10markets. Although inventory grew in most markets during June, growth remained restrained with all markets showing increases of less than 4%.

All markets except Boston and San Francisco had a median days-on-market of 100 or more in May. By far, the market with the slowest rate of inventory turnover was Miami with a median of 262 days-on-market or more than eight months. The Altos 10-City

Price Index:

$697,376 - April

$720,060 - May

$742,596 - June

3.1% - % change May to June

6.5% - 3 mo. % change

Listing Inventory:

10,283 - April

9,302 - May

9,014 - June

-3.1% - % change May to June

-12.3% - 3 mo. % change

Average Days on Market:

96 - April

96 - May

94 - June

-1.4% - % change May to June

-1.9% - 3 mo. % change

SOURCE: ALTOS RESEARCH

Labels:

economic news,

home sales,

real estate,

san francisco

Pending home sales up 3.6% in June

The number of contracts to buy previously owned homes in the U.S. rose in June for a fifth straight month and exceeded economists’ forecasts, as lower prices and mortgage rates attracted buyers.Good news on top of April's big increase of 6.7%

The 3.6 percent gain in the index of signed purchase agreements, or pending home resales, followed a 0.8 percent gain the prior month that was larger than previously estimated, the National Association of Realtors said today in Washington.

Foreclosure-driven declines in home values and tax incentives are putting houses within reach of first-time buyers, helping to stabilize the real-estate market, which has been the biggest drag on economic growth. At the same time, with mortgage rates no longer dropping and unemployment still rising, it may be months before a sustained recovery in housing takes hold.

“It’s a modest recovery, however these numbers are exceeding people’s expectations,” said David Sloan, senior economist at 4Cast Inc. in New York, one of three forecasters who shared the highest projection in a Bloomberg News survey. Nonetheless, he said, while there are “genuine signs” of recovery in housing and manufacturing, “the consumer is still the big sort of worry.”

SOURCE: BLOOMBERG

Thursday, July 30, 2009

Sub-marketing gone wild!

Vegetarian real estate agents? Yes, in the push to find new clients, one agent in Palo Alto is reaching out to fellow veggies and vegans.

Oh, and being 70% vegan myself (more for health and environmental reasons than animal-cruelty), I would never hire a vegetarian. I find milk products to have more negative health aspects than a steak. So call me, the steak-eating vegan, for all your real estate needs!

SOURCE: SFGATE

You couldn't make this stuff up. A Bay Area real-estate agent is marketing himself as a "vegetarian broker". This being his unique selling proposition, presumably he hopes to reel in like-minded veggie lovers as clients.I find this to be a noble, interesting tactic. The only problem is how to get that message to your targeted audience. Advertise at Gratitute Cafe? Possibly. But is that money well spent? That's the trade off he's willing to take, if he is advertising his veggie-ism.

"Are you a vegetarian or vegan preparing to buy or sell a house? Are you dreading the thought of the contact you will be forced to have with real-estate agents, as part of the process (the same way most people dread upcoming encounters with used car salesmen)? You are not alone!" broker Daniel Berman from Pacific Century Realty writes on his website.

Berman addresses the obvious question -- what difference does it make to have a real-estate agent who is vegetarian as opposed to a meat eater -- head on. "Simply stated, it's a matter of shared values, an approach to life and a way of relating to others," he says. Adding: "If you've been a vegetarian (or vegan) for any length of time, you know what I mean."

Oh, and being 70% vegan myself (more for health and environmental reasons than animal-cruelty), I would never hire a vegetarian. I find milk products to have more negative health aspects than a steak. So call me, the steak-eating vegan, for all your real estate needs!

SOURCE: SFGATE

Wednesday, July 29, 2009

Credit where credit is due

Hats off to Lennar for designing a new home community in Palm Springs with modern design, hopefully beginning the decline of stucco-clad homes. The master planned community is called Escena Palm Springs.

After working for years in the East Bay with Toll Brothers, Lennar, Pulte and KB Homes, I'm excited to see a builder FINALLY building homes that look like something out of this millennium. This is actually something I would consider buying.

Next up: high density modern design. But one step at a time...

SOURCE: LENNAR

Case-Shiller numbers for May up from April

Data through May 2009, released today by Standard & Poor’s for itsThe San Francisco MSA increased from 118.46 to 120.16, a 1.4% increase. This is down from 162.70 in May 2008, and well below May 2007's number of over 200.

S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, show that, although still negative, the annual rate of decline of the 10-City and 20-City Composites improved for the fourth consecutive month in 2009.

“The pace of descent in home price values appears to be slowing” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “There is a clear inflection point in the year-over-year data, due to four consecutive months of improved rates of return, after the steep decline that began in the fall

of 2005. In addition to the 10-City and 20-City Composites, 17 of the 20 metro areas also saw improvement in their annual returns compared to those of April.

“While many indicators are showing signs of life in the U.S. housing market, we should remember that on a year-over-year basis home prices are still down about 17% on average across all metro areas, so we likely do have a way to go before we see sustained home price appreciation.” Mr. Blitzer added.

SOURCE: S&P

Labels:

case-shiller,

economic news,

real estate

Tuesday, July 28, 2009

New home sales up big; down 21% from June 2008

Sales of new homes in the United States posted their largest monthly gain in eight years in June, the government reported on Monday, a sign that the housing market is bottoming as buyers take advantage of lower prices.SOURCE: NY TIMES

The Commerce Department reported that new single-family home sales rose 11 percent in June, an increase that dwarfed economists’ expectations of a 3 percent increase. The pace of home sales rose to a seasonally adjusted rate of 384,000 a year, the highest level since November.

Despite the monthly increase, sales of new homes were still down 21 percent from June 2008, and the market is still swamped by a glut of for-sale houses and foreclosed properties.

“These are still really bad numbers,” an economist at IHS Global Insight, Patrick Newport, said. “The market just couldn’t have dropped much further.” As sales rose, median prices of new homes continued to fall, slipping to $206,200 from $232,100 in June a year ago.

Labels:

economic news,

new developments,

real estate

Monday, July 27, 2009

Would development fee moratorium spur growth?

Oz Erickson offers a possible solution to the grid-lock facing residential builders in San Francisco

SOURCE; BIZ JOURNALS

Erickson said San Francisco should consider a three-year moratorium on development fees. “The city has to do something really really significant to jump-start residential construction,” Erickson said.We have a call out to Chris Daly and Bevan Dufty's offices seeking comment or alternative suggestions. Will update you once we hear back.

SOURCE; BIZ JOURNALS

Labels:

commercial real estate,

condos,

new construction,

real estate

More appraisal woes

The good news is that sales volumes of new construction are rising; the bad news is they're doing so despite growing trouble with appraisals.SOURCE: CNBC

I can't seem to talk to anyone in the real estate industry on any topic without hearing something about appraisals. We've been over the new appraisal rules, requiring the fire wall between lenders and appraisers. We know the new rules are resulting in less qualified appraisers, perhaps with no knowledge of a local market, mucking up the process.

Now we're hearing from builders that appraisers are using distressed properties, that is foreclosures and short sales, as comps for new construction. In her monthly homebuilding Survey, analyst Ivy Zelman notes:

Commentary in this month’s survey was dominated by frustration with inconsistencies in the appraisal process. Survey respondents are concerned that these appraisal issues will make it difficult to stabilize home values, as appraisers are being extremely conservative using foreclosures and short sales predominantly as comps, based on fears of potential backlash or liability.

Home builders are in direct competition with foreclosures in many markets, because a lot of foreclosures are new construction.

Labels:

appraisals,

economic news,

new construction,

real estate

A quick barometer of where we're at...

Companies that a few months ago were too fearful even to project their future earnings are now seeing glimmers of hope in the year ahead. The rate of home sales has risen for three straight months. And the number of people drawing unemployment insurance benefits has fallen back to April levels, having receded for the third straight week.SOURCE: WASHINGTON POST

All those recent signals sent the stock market surging Thursday as investors sensed that the recession could be in its waning days. Many suspect that even if no recovery is imminent, the steep economic decline has either already ended or will soon.

That confidence drove the stock market, as measured by the Standard & Poor's 500-stock index, up 2.3 percent Thursday -- continuing a rally that has driven the broad measure up 44 percent since March 9 and 11 percent in the past two weeks. The Dow Jones industrial average has gained 39 percent since March 9 and closed above 9000 for the first time since January. European markets rose by a similar amount on Thursday, and Asian markets opened up in early trading Friday.

Thursday, July 23, 2009

Home sales rise for 3rd consecutive month

.jpg)

More good news keep coming in

A real estate trade group said on Thursday that sales of previously occupied homes rose 3.6 percent from May to June, the third consecutive monthly increase.SOURCE: NY TIMES

The National Association of Realtors said that home sales rose to a seasonally adjusted annual rate of 4.89 million last month, from a downwardly revised rate of 4.72 million in May.

It was the highest level of sales since October 2008 and beat economists’ expectations. Sales had been expected to rise to an annual pace of 4.84 million units, according to Thomson Reuters.

Labels:

economic news,

home sales,

real estate

New details on SWL 337

The estimated $2.2-billion development proposal is for the creation of a new neighborhood, the Mission Rock District, which includes SWL 337, China Basin Park, Pier 48 and portions of Terry Francois Boulevard. The design shows SWL 337 broken into 10 city blocks built up with one million square feet office space, 240,000 square feet of retail space, 875 apartment units and open space. The plan for Pier 48 calls for 181,000 square feet of event space.However, the deal is not ready yet

The developer team is asking for 75- and 66-year leases for SWL337 and Pier 48, the maximums allowed by state law. The Port is projected to receive base rent totaling $208 million between 2013 and 2053. Though the submittal has no specific proposal for base rent increases, the pro forma shows $254 million in “performance rent” between 2013 and 2053 roughly equal to base rent escalations every five years at the rate of inflation.

Its development proposal outlines an approximately four year period to conduct due diligence and obtain all required entitlements followed by a four-phase, 17 year site build-out commencing in 2013. The historic rehabilitation of Pier 48 is proposed to take place between 2022 and 2026.

Stern tells GlobeSt.com the exclusive negotiating agreement between the Port and the development team should be hammered out sometime this fall. The Port was not very impressed with the developer team’s initial proposal for Pier 48, which could be cut out of the agreement if a better proposal isn’t received, according to the latest staff report.SOURCE: GLOBE ST

“The proposal’s treatment of Pier 48 seems to be incomplete, offering rents below current interim lease rates with major improvements at Pier 48 delayed until 2026,” states the report. “Based on the current proposal, Port staff does not believe a long-term lease is warranted at Pier 48. If the Port Commission chooses to proceed, Port staff would seek revisions to the proposal regarding Pier 48 or evaluate whether Pier 48 should be included in the scope of a long-term development agreement.”

Labels:

new developments,

real estate,

san francisco,

SWL 337

Lending activity flat from April to May; originations down due to rate increases

From the Obama Administration comes a snapshot of lending in May (the most recent month for which data is available)

The overall outstanding loan balance ... was flat from April to May at the top 21 participants in the Capital Purchase Program (CPP). Total origination of new loans at the 21 surveyed institutions increased 1 percent from April to May.And as we noted back in June

In May, the 21 surveyed institutions originated approximately $277 billion in new loans. Total originations of loans by all respondents rose in four categories, specifically: mortgages, credit card loans, commercial real estate renewals and commercial real estate new commitments.

Total originations fell in the following three loan categories: home equity lines of credit, other consumer lending products, and commercial and industrial renewals, and were flat in one loan category, commercial and industrial new commitments.

Many respondents reported high mortgage application volume through the month of May, but indicated that pipelines decreased as rates began to rise toward the end of May.SOURCE: US TREASURY DEPT

Labels:

economic news,

mortgage rates,

real estate

Commercial real estate down 7.6% from April to May

According to data compiled by MIT's Center for Real Estate, their Moodys/REAL Commercial Property Price Index dropped 7.6% from April to May. This represents a 28.5% drop from May 2008, and down 34.8% from the October 2007 peak.

Transaction volumes are at the lowest point this cycle, coming in at $2.7 billion on 282 transactions, 52 which are considered "repeat-sales" transactions.

The silver lining, however, might be that this month-to-month decrease is less than April's 8.6% decline. We'll see next month whether the trend continues to improve.

SOURCE: MIT CENTER FOR REAL ESTATE

Labels:

commercial real estate,

economic news,

real estate

Wednesday, July 22, 2009

San Francisco to receive hundreds of millions for new developments

Bay Area government officials on Tuesday announced they received $229 million from the state to build housing near transit hubs and other developments that increase housing density.SOURCE: BIZ JOURNALS

The money will go toward transit-oriented developments in San Francisco and Hayward and “infill housing” - new housing built where housing already exists - in San Jose, San Francisco, Oakland, Hayward, Fremont, Union City, El Cerrito, Pittsburg, Sunnyvale and Santa Rosa.

“This state action bolsters efforts in our region to focus our growth and leverage our transportation investments to help the Bay Area achieve goals for compact growth, preservation of agricultural lands and open space and to help protect the climate,” said Scott Haggerty, chairman of the Metropolitan Transportation Commission and a Alameda County supervisor in a statement.

The money comes from California Proposition 1C, which was approved by voters in 2006 to promote infrastructure development and housing.

Labels:

condos,

new developments,

real estate,

sustainable development

Title insurance fees under fire

Possibly good news for consumers

The U.S. title-insurance industry faces increasing pressure from regulators to justify the fees charged to consumers for ensuring they have clear ownership of their homes.SOURCE: WSJ

For most people, title insurance is just another mysterious fee they must pay when they buy a home or refinance a mortgage. Unlike some of those fees, though, title charges aren’t negligible. They range from several hundred to several thousand dollars—and last year totaled more than $10 billion for the title industry. Lenders insist on the insurance to protect them against the possibility that a taxing authority, another creditor or a disgruntled heir may have a claim to the property, among other risks...

A bigger potential threat to title insurers comes from the Obama administration’s proposed Consumer Financial Protection Agency. The new regulator would oversee a wide variety of financial products, including title insurance, which is now regulated mainly at the state level. That would open the door to more federal oversight.

Labels:

real estate index fund,

title insurance

Tuesday, July 21, 2009

San Francisco moving forward with major development projects

Despite the economy, many infrastructure and housing projects are moving forward, according to Mayor Gavin Newsom. Speaking at a breakfast last week, sponsored by the SF Business Times, the news was cautious but still ambitions

The city will start construction later this year to rebuild San Francisco General, environmental review for the second phase of construction at Hunters Point is nearly complete and the city is close to reaching an agreement with the federal government to transfer Treasure Island, Newsom said.SOURCE: BIZ JOURNALS

The mayor’s comments come as the city is struggling with rising unemployment and falling revenue. Unemployment reached 9.1 percent in May, up from 4.3 percent a year ago. The city had to close a $438 million deficit — caused in part by declining revenue — by cutting services.

Still the mayor sought to contrast San Francisco’s woes with troubles elsewhere.

“Our unemployment rate is high,” Newsom said, “but it’s among the lowest of any of the counties of California. Our bond rating is low, but it’s the highest of all these counties in California. Our vacancy rates may be high but for class A I’m glad I’m not in South San Francisco. I’m glad I’m not in San Mateo. I’m glad I’m not in Redwood City. And I’ sure as heck glad I’m not in Palo Alto or San Jose. We’re doing much better on relative terms.”

Labels:

new developments,

real estate,

san francisco

Pacific Union sold to smaller, Marin-based firm

Pacific Union, part of GMAC, is being sold to Morgan Lane Marin, a smaller company:

Boutique real estate firm Morgan Lane Marin Inc. is swallowing its larger competitor, Pacific Union GMAC Real Estate, in an acquisition that promises to create a local brokerage powerhouse, but could also entail serious challenges in this sluggish housing climate.SOURCE: SF CHRON

The deal, for an undisclosed sum, will bring together 17 Bay Area offices and more than 430 real estate professionals, with combined sales volume projected to reach $2.2 billion this year. As recently as 2000, Pacific Union alone was boasting sales of $3.2 billion, a difference that highlights the recent fallout in the brokerage industry and strongly hints that Morgan Lane picked up its rival at a discount.

Mark McLaughlin, chief executive officer of the Marin real estate company, said he pursued the deal because it offered a chance to inject the entrepreneurial attitude of his high-end-focused firm into a dominant local brokerage. Pacific Union is among the top five regional real estate companies and also focuses on the luxury end.

Labels:

brokerage,

real estate,

san francisco

Monday, July 20, 2009

Roubini: recovery to be "very ugly"; recession over Dec 2009

Nouriel Roubini, the economist whose dire forecasts earned him the nickname "Doctor Doom", told CNBC Monday that the economic recovery is going to be "very ugly."SOURCE: CNBC

"The recovery is going to be subpar," Roubini said. "I see a one percent growth in the economy in the next few years. There will also be 11 percent unemployment next year and the recovery is going to be slow. It's going to feel like a recession even when it ends."

Asked about his comments in a speech last week about the recession ending in 2009, Roubini said, "I've been saying all along the recession is going to last 24 months. It started in December of 2007 and my view is that it won't be over until December of this year."

Commercial mortgages falling

Commercial mortgages at U.S. banks have been failing at the fastest rate in nearly 20 years, the Wall Street Journal said, citing its own analysis.SOURCE: REUTERS VIA YAHOO

Losses on loans used to finance commercial spaces would possibly reach about $30 billion by the end of 2009 at the current rate, the article said.

Friday, July 17, 2009

Foreclosures at record high

According to data from RealtyTrac, foreclosures have reached an all-time high:

A record 1.53 million properties were in the foreclosure process -- default notices, auction sale notices and bank repossessions -- during the first six months of 2009. That was 9% more than the previous six months and 15% more than the same period of 2008, according to a report released Thursday by RealtyTrac.SOURCE: CNN

There were a total of 1.91 million filings resulting in 1 out of every 84 U.S. properties receiving at least one filing in the first half of the year. Banks repossessed 386,800 properties.

"What this means is, despite the intensity of the efforts on the part of government and lenders we don't have a handle on foreclosures yet," said Rick Sharga, a spokesman for RealtyTrac.

And, in a bad sign for a housing recovery, there was no recorded improvement in June, the last month of the cycle. More than 336,000 homes reported foreclosure filings, the fourth straight 300,000-plus month. Filings were up 33% over last June and nearly 5% compared with May.

Labels:

economic news,

foreclosures,

real estate

Dr. Doom thinks the worst is behind us

"I have said on numerous occasions that the recession would last roughly 24 months. Therefore, we are 19 months into that recession. If as I predicted the recession is over by year end, it will have lasted 24 months with a recovery only beginning in 2010. Simply put I am not forecasting economic growth before year's end."SOURCE: CNBC

"On one side, early exit from monetary and fiscal easing would tip the economy into a new recession as the recovery is anemic and deflationary pressures are dominant," Roubini said. "On the other side, maintaining large budget deficits and continued monetization of such deficits would eventually increase long term interest rates ... and thus would lead to a crowding out of private demand.

"While the recession will be over by the end of the year the recovery will be weak given the debt overhang in the household sector, the financial system and the corporate sector; and now there is also a massive re-leveraging of the public sector with unsustainable fiscal deficits and public debt accumulation."

Monday, July 13, 2009

Sellers might still be liable for losses after short sale

Check the fine print before going ahead with a short sale:

Bank of America, which bought Countrywide in 2008, advised Lopez’ client to pursue a short-sale when he sought a plan to cut his monthly payments. Lopez says he was stunned when BofA sought a note from his client, a former contractor who now delivers pizza and drives a truck for a fish company, to help make up the gap between the mortgage balances and the short-sale price.SOURCE: BIZ JOURNALS

The rising tide of “short sales” by troubled home owners facing foreclosure is prompting lenders to become more aggressive in their attempts to pursue former homeowners for their loan losses in a short sale. In a short sale, a house is sold, with a lender’s approval, for an amount that won’t pay off the mortgages on the property.

Often, the troubled home owner assumes the loss will be eaten by the lender. But Bank of America and Chase have quietly added language in their short-sale agreements that require the borrower to sign a promissory notefor the shortfall.

Housing bottom? An agrument for an end to declines

Larry Edelson, a macro-economist with over 30 years of successfully predicting large market movements, opines as to his thoughts on a real estate bottom (nationwide). Although much of this information will be repetitive to HighRiseSF readers (we've discussed inventories and affordability here many times) it is a concise argument worthy of debate.

The second concern is how unemployment will factor into any further foreclosures. Will the majority of homeowners remain in their homes over the next 6-12 months, and keep current in their mortgages? With the rise in Alt-A and prime mortgages heading to foreclosure, it's a possibility we may see more declines due to increased inventory. Will this have a big impact on the San Francisco real estate market? Keep an eye on the HR departments of the largest tech companies as a leading indicator.

We'll keep you posted on how things progress.

SOURCE: BLOGGING STOCKS

"...all the evidence I see tells me real estate prices in the U.S. are now a bargain ... that we're at the bottom ... and that there will be a recovery in property prices, albeit slowly, over the next several years.The data is well thought-out and reasoned, but there are certain factors which lead me to be more cautious. One is the supposed "ghost supply" of houses owned by banks but not coming on the market as REO's yet. The rumor is that there are hundreds of thousands, if not millions, of homes waiting for a better time to come on the market, so banks don't loose as much on the deals.

"Amongst the evidence I see ...

#1. New home inventories are now at previous recession lows. This is not to say inventories of new homes can't fall lower. But as inventories fall, so does the supply of new homes, which is generally bullish for prices. Looked at another way, the bulk of the oversupply of new homes has largely been worked off.

#2. Existing home inventories have also fallen sharply. Although they have not plunged as low as one might expect from looking at this chart, they have not only peaked, but they have fallen to an area that should find support

"The inventory of new homes has fallen well below its 40-year average, to levels that have marked previous recession lows in inventories.

"Also note that due to foreclosures, short sales, and other workouts going on in the real estate market, existing home inventory data is likely to lag the bottom in real estate prices.

#3. Anecdotal evidence points to a pickup in demand. The Pending Home Sales Index, a leading indicator and a measure of home sales that will go to contract within two months, has risen for four months straight.

"Existing home sales have also been on the rise, increasing 6.2% since the start of the year. Meanwhile, the median sales price of existing homes has jumped almost 5% in the same period.

#4. Housing affordability has come back down to the CPI inflation trend line. I find this chart especially interesting. Courtesy of Investech Research, it's a picture of housing prices vs. inflation as defined by the (conservative) Consumer Price Index since 1980.

"The median family home price has collapsed back to the growth rate of inflation, per the CPI. Put another way, the median home price is back to inflation-adjusted levels, with the majority of the price deflation behind us.

"What's more, the National Association of Realtor's Housing Affordability Index is now in record territory, indicating that housing prices are now more affordable than they've been since this index was created in 1970.

#5. On an international basis, U.S. property prices are cheaper than they've been in at least 10 years. Consider the following: The U.S. median home price has fallen 21.3% - more than $56,000 - since its peak at $262,600 in March 2007.

"In terms of the international purchasing power of the dollar, which has declined precipitously, the median price of a single-family home has fallen more than 35% to levels last seen in 1998.

"That's due to the decline in the international purchasing power of the dollar since 2001, coupled with the decline in housing prices in dollar terms.

"In my view, the decline in the value of the dollar will become an important stabilizing factor in U.S. real estate prices. It means more foreign investors should soon be investing in U.S. property, bolstering demand and even pushing up prices.

The second concern is how unemployment will factor into any further foreclosures. Will the majority of homeowners remain in their homes over the next 6-12 months, and keep current in their mortgages? With the rise in Alt-A and prime mortgages heading to foreclosure, it's a possibility we may see more declines due to increased inventory. Will this have a big impact on the San Francisco real estate market? Keep an eye on the HR departments of the largest tech companies as a leading indicator.

We'll keep you posted on how things progress.

SOURCE: BLOGGING STOCKS

Labels:

economic news,

foreclosures,

real estate

Saturday, July 11, 2009

New lending guidelines hampering non-default related sales

Anecdotal story from the NY Times that relates to problem #2 on our list of 5 factors holding down the current real estate market, credit availability

We still have a long way to go...

SOURCE: NY TIMES

Despite a good credit score, a six-figure income and an ample down payment, Dr. Komarovskaya, a recent dental school graduate, could not get a loan. Her mortgage broker told her she ran afoul of new rules requiring two years of sufficient tax returns from some home buyers, instead of only one.The unwillingness of lenders to loan money to qualified buyers will keep the brakes on the current market. And this is only problem #2 of 5 which needs to be resolved.

“Everyone says this is a buyer’s market, but they wouldn’t let me buy,” said Dr. Komarovskaya, 30. “It’s not fair.”

Not fair, perhaps, but far from unique, brokers and agents say. The readiness of banks to sell foreclosed properties has led to rising home sales in some areas. But the traditional housing market, the one that involves willing buyers and sellers, is still dead, with transactions lower than they have been for decades.

The recession is the major reason sales are dragging, of course, but it is not the only one. As Dr. Komarovskaya found, buyers once viewed as perfectly qualified are being denied mortgages.

Brokers and bankers say that in past decades, the credit markets would almost certainly have accommodated many of these people.

We still have a long way to go...

SOURCE: NY TIMES

Labels:

affordability,

first time buyers,

mortgage rates,

real estate

3rd largest REIT raising $1 billion vulture fund

Vulture funds are starting to emerge to take advantage of the current and future drops in commercial real estate

SOURCE: BLOOMBERG

Vornado Realty Trust, the third- biggest U.S. real estate investment trust by market value, is trying to raise $1 billion to invest in real estate assets, according to a person with knowledge of the fundraising.Hey Vornado, I know a few projects in San Francisco you might be interested in (i.e. Turnberry's lot on Lancing Street).

Property investors including REITs are raising money from stock investors and through private funds to take advantage of falling real estate prices as debt financing becomes scarce.

Vornado, which owns mainly office and retail properties, is one of about 50 REITs that raised a total of $15.7 billion from equity sales through June 26, according to the National Association of Real Estate Investment Trusts, the trade group based in Washington. Vornado completed a $741.8 million stock sale in April with proceeds earmarked for cutting debt and making acquisitions.

U.S. commercial real estate values fell almost 23 percent through March 31 from the peak in October 2007 as credit dried up, Moody’s Investors Service said May 18.

SOURCE: BLOOMBERG

Labels:

commercial real estate,

new developments,

turnberry

Thursday, July 9, 2009

On the plus side...

The W Hotel is being sold:

SOURCE: GLOBE ST

Starwood Hotels & Resorts Worldwide Inc. is under contract to sell the 404-room W San Francisco hotel for $90 million or $220,000 per key, far below what luxury hotels in San Francisco were selling for in 2006. The agreement with Keck Seng Investments Ltd., which owns three other Starwood hotels and is listed on the Hong Kong stock market, calls for Starwood to retain the long-term management agreement and to continue operating the hotel under the W flag. The sale is expected to close on July 30, 2009.It's good to see transactions happening.

Starwood, which opened the hotel amid a strong economy in 1999, says the sale price is 14 times the property’s anticipated 2009 EBITDA. Atlas Hospitality Group president Alan Reay tells GlobeSt.com that translates to a 7.1% cap rate at a time when most hotel investors are seeking a double-digit cap rate.

“Starwood is getting a very, very good cap rate based on other deals,” Reay says. “What we see is most buyers are underwriting to a 10% cap or above, so must be someone from Hong Kong that sees this as a real opportunity relative to ’06-’07 pricing.”

The value of hotels in San Francisco has fallen between 50% and 80% from their peak values in 2006 and 2007, when new or newly renovated full-service upscale properties were trading for between $360,000 and $520,000 per key.

SOURCE: GLOBE ST

Labels:

commercial real estate,

hotels,

san francisco

Four Seasons in default

Millennium Partners this week acknowledged purposely defaulting on its two-year-old, $90-million CMBS loan for the 277-room Four Seasons San Francisco with hope of renegotiating the debt with the special servicer, LNR Property Corp., because the hotel, once valued at $135 million, is now worth less than is owed. The strategic move appears to be working for Millennium and others in California, which has industry experts expecting a lot more of it.No word on whether they plan on defaulting on their latest project, the Millennium Tower at Mission and Fremont Streets

"What we are finding now is that--because on CMBS loans the companies cannot get any response from the master servicer--the only way of trying to renegotiate is to default because only a special servicer can modify the loan," Alan Reay, president of Irvine, CA-based Atlas Hospitality Group tells GlobeSt.com. "My prediction is you are going to see vast majority of CMBS loans in California--probably throughout country--defaulting." ...

"In order to commence discussions with the debt holders of the Four Seasons Hotel in San Francisco, Millennium Partners has strategically withheld payment of debt service," Millennium Partners said in a statement. "Conversations on restructuring the debt have begun, and Millennium Partners is hopeful that they will result in a positive outcome."

SOURCE: GLOBE ST

Commercial real estate "ticking" time bomb?

So says the Honorable Congresswoman from NY:

U.S. lawmakers rang alarm bells about the troubled commercial real estate industry, which has been walloped by the credit crunch and an implosion of property values.SOURCE:WSJ

"The commercial real estate time bomb is ticking," Joint Economic Committee Chairman Carolyn Maloney, D-N.Y., said in opening remarks to a hearing before her panel Thursday.

A wave of defaults of commercial real estate loans would deal a blow to the already weakened economy and banking sector. The U.S. commercial real estate market is roughly $6.7 trillion in size and is underpinned by about $3.5 trillion of debt.

A panel of witnesses painted a dire picture for lawmakers. Property values have plunged 35%-45% in many markets as transactions have slowed to a crawl, Deutsche Bank Securities Inc. (DB) mortgage analyst Richard Parkus told lawmakers.

The market won't begin to recover until 2012, or even later, he said. "We believe the bottom is several years away," he added.

Plunging property values are further hampering developers' ability to refinance their debt or loan extensions, the industry said.

Commercial real estate back to 2004 prices

Ruh roh

In conjunction with MIT Center for Real Estate and Real Estate Analytics, LLC, Real Capital Analytics has launched a set of pioneering indices for tracking commercial investment property prices in the US. The CPPI indices published by Moody's are based on actual transactions of commercial real estate compiled by Real Capital Analytics.SOURCE: REAL CAPITAL ANALYTICS